Last Updated on June 14, 2023 by Ellen

Many people say their dream is to “travel the world in retirement” before they are too old or sick to fully enjoy it.

We had that dream, too. We made it a reality when we added a few words to that lofty phrase: budget slow travel in early retirement.

Budgets are relative. But our budget in 2023 is still $2,000 a month — the same budget as when we started budget slow travel in early retirement back in 2015!

By slow travel, we mean exploring a region by bus and train, not flying often, and taking our time. It saves money, and we see more. After all, the faster you go, the less you see. Besides – we’re early retired! That means we have the time – and stamina – to make this a lifestyle.

The pandemic couldn’t stop us. We temporarily lived in the Philippines while doing some humanitarian projects. We made the best of a crappy situation.

Breast cancer couldn’t stop us. Ellen had surgery, healed, and we kept traveling. And we’ve been going since!

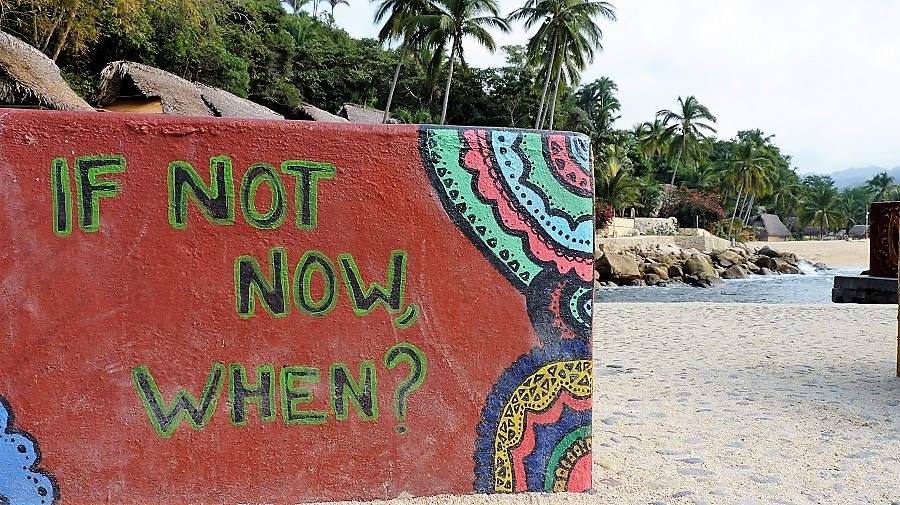

So: what’s stopping you from living the dream?

You can travel the world in retirement

If you have planned for early retirement, but lack the courage to make the leap, this is a pep talk on how you can travel the world in retirement. It can be early retirement, or not. You can have a larger, or smaller, budget than ours.

Life is what you make it. And: Life is Now.

When Tedly and I took our first trip to Mexico together in 2002, I told him on the plane ride back to Cleveland, Ohio, I wished we could do nothing on a beach every day. I cried as the plane took off — leaving fun and fantasy behind. Wouldn’t it be great to have beaches and cultural explorations and laughs as a lifestyle? I made Theo promise me we would return together on more fantastic trips. He kept his promise.

On our work vacations, we explored ways to “live” on a budget during our seven to 10 days off. We went to Mexico, Nicaragua, Panama, Costa Rica. Instead of all-inclusive resorts, we found mom-and-pop hotels with small kitchen areas, or studio apartments. This was way back before Airbnb!

Our trips showed us the savings could be astounding when compared to typical resort vacations. We spent just a few hundred dollars to live in a tropical climate, in an exotic environment, for a week to 10-days – including airfare! We knew we could cut down our expenses even more if we tried this lifestyle full time.

It is a commitment. Once the stuff is all sold and the slow travel starts, it’s a whole new life. In our case, it’s a dream life.

Top 5 reasons people don’t travel the world in retirement

There are five common reasons or concerns I hear from family, friends, blog readers, strangers, and vacationers we meet on our travels about why they “can’t” quit their jobs and travel the world right now.

For each of these five fears, I will offer a counter-point with the type of positive thinking that helped us become comfortable with our radically different lifestyle of budget slow travel in early retirement.

And remember: it’s not only positive thinking — we are actually doing it! Since 2015!

1. I don’t have enough money

How much is enough? How much do you need?

What is your actual net worth?

How much do you spend now on your current lifestyle?

Do you track your expenses on a daily basis?

Answer these questions. If you know how to reign in your spending, and if you know how much cheaper life can be outside of the U.S.A., you’re closer than you think to the ‘magic number.’

And, your answers might reveal you’re on a pretty good start to negating the most common reason we hear from people about why they can’t quit the rat race and travel the world in retirement.

It took years of planning with some sacrifices to get to where we are today. Some lifestyle choices we personally made:

- no kids (although children are not a deal breaker, more on that in the next point)

- no new or leased cars all the time

- continuous saving

- living below our means for many years

We did not live extravagantly then, nor do we live ‘high on the hog’ now. We didn’t hit the lottery or inherit a cent.

Yet today, we have an extremely comfortable life in early retirement outside the U.S. No fancy, five-star hotels, no frequent flights. But we are extremely comfortable and we enjoy our budget slow travel lifestyle!

So, really – how much money is enough to travel the world in retirement?

Our budget is around $2,000 a month, give or take, depending where in the world we live. We stress: that’s for two people! (Find links to our budget breakdowns here.)

Some blog writers say they retired early abroad for $1,500 a month or less, once they discovered how cheap it can be to live outside the USA. We could easily spend that – or less – if we settled in somewhere, like traditional retirees often do.

In fact, the pandemic put us in one spot for a long time in the Philippines. Our living expenses without any ‘slow ravel’ were so low in that developing nation that we had leftover money to sponsor various community projects and help people who lost income with no tourism. It was our pleasure!

But we don’t settle in like traditional retirees. So, when the coast was relatively clear of COVID hazards, we split. We have been on the move again ever since April 2022.

Ask yourself this: if you have financially prepared – or you are preparing – for early retirement, and you sold everything right now, would your nest egg allow for spending $1,500 (single) to $2,000 (couple) a month until you can collect social security and/or money from retirement accounts?

Because that’s all it takes– less than 2K a month — in developing, exotic, awesome countries like the Philippines, Thailand, Vietnam, Guatemala, and others. If you want to budget slow travel in Europe, you’re looking at higher costs, of course.

If you don’t have that amount to live on before the traditional retirement age, but you still want to retire early, you have to get serious about reining in your spending, increasing savings, and/or creating other income.

Own a property? Rent it. Have a computer? Work online. There are income streams you can create – but again – this is not a ‘how to’ piece on wealth accumulation.

This is a pep talk for people who are serious about budget travel in early retirement. It’s for people who have already taken financial steps – or are taking them right now.

Related: The first 4 early retirement steps to take right now

2. I have kids

Congratulations! We hope you find parenthood to be a satisfying journey.

We never wanted kids. However, there are many early retirees and early retiree planners who do have children. We’ve met many. And so we know it is possible to save money and have the joy of children to boot.

I have no direct experience of saving money with kids in the house — but I know of resources that might help you.

Check out some early retirement blogs with useful information on saving with kids here. That link also has great blogs by people without children, and Millennials who see the wisdom of financial freedom.

3. I’m worried about health care

Valid concern. I should know! I’ve had my share of health issues, and so has Theo.

I was diagnosed with breast cancer while traveling! I’ve had mammograms, biopsies, and a double mastectomy in foreign countries.

Not to mention other more common health issues we’ve had, like Chikungunya and dengue (mosquito viruses), emergency root canals, broken bones (wrist and toe), something pulled out of Theo’s throat, and more.

But guess what? I’m still here to cheer you on!

Health care outside the USA is often excellent — and affordable. We’ve experienced this — including the emergencies I mentioned. Americans are conditioned to think otherwise. Don’t be enslaved to a lie.

Are you relatively healthy? If not, are you able to take control of your lifestyle choices and become healthy?

If you are healthy, or if you have manageable health issues, you can easily find health care solutions in countries outside the U.S.

Let’s face it – medical tourism is a reality because Americans can get the same level of care abroad for a significantly lower price.

Yes, it can take a bit of courage to trust a foreign doctor, dentist, hospital, or clinic. But it becomes easier with time and experience.

Everything from dental care, to prescription eyeglasses, to cancer surgery and follow-up treatment. The rest of the world survives just fine on other health care systems – Americans are duped into not believing that. We could write a book one day on our health care experiences abroad, and perhaps we might.

Nothing in life is guaranteed, including our health – no matter where in the world we happen to be.

There are two keys to this health care issue. First, stay healthy enough to not need medical care in the first place, and second, be open to accept help when you do need medical care abroad.

To read some posts about our medical care as we travel the world in retirement, visit the Health Care Abroad page.

Now hit the final two reasons why people say they cannot travel the world in retirement.

4. I might miss my family

Yep. You might. I do. I miss my sister somethin’ awful sometimes. But we talk on video or audio chat, we text, we can plan to visit each other. (It’s not the same.)

Why complicate this?

Are you living your life for you, or your family?

I hear this reason not to travel most often from older retirees with grandchildren.

That said, we’ve met a lot of people, including grandparents, who decided to travel the world in retirement anyway because they are living their lives as they want.

Their solution: visit your family, or invite family to visit you.

If staying near your family is a real reason to forget the travel dream — great! But don’t use it as a cop out when the real issue is you are too full of fear.

5. What about my life’s purpose?

My questions: is your life’s purpose the daily routine you are living now? Are you happy right now?

Only you can answer those questions.

Some of us budget slow travelers find purpose in life when we’re out here, like when we volunteer to help refugees in Greece, or feed garbage pickers in Mexico, or build a shelter for a disabled man, or bring water and electric service to an indigenous tribe in the Philippines — in a pandemic!

Anything can happen out here. For real. And much of it can be life changing!

Know why? Because life is what you make it. And we believe: Life is Now. That’s why we budget slow travel now – in early retirement. Wacky climate change, inflation, wars, pandemics — we don’t want to wait, because tomorrow’s not promised.

Aside from life-changing volunteer efforts, we also relax – a lot!

We get to chose how we spend our time.

That might mean a casual museum visit to learn something new.

Or perhaps we spend time with a Maya woman who invited us into her home, to demonstrate the old, traditional way to make tortillas and beans.

Deciding which unforgettable views of the Himalayas to enjoy over breakfast is a dream come true.

Maybe we feel adventurous and want to take a long hike on an overnight camping trip for a front row seat to an active volcano in Guatemala.

Perhaps we want to jump into the Caribbean Sea with all kinds of creatures to dive or snorkel.

Or, maybe we want to spend some time to help care for elephants in Northern Thailand.

The choices are ours.

Those examples – and so many others – are possible because we aren’t shackled by fear. Sure, there is some risk with this lifestyle, but it’s a highly calculated risk.

We planned for this, and we’ve been at it since 2015. Our example is proof positive it’s entirely possible to budget slow travel the world in early retirement.

Bonus: More on the money

Most likely, you are still worried about the money – the number one reason people don’t travel the world in retirement.

We are not financial advisors, but we have put an opinion piece together on whether or not you really need a million dollars to retire early and travel the world. Read that here.

So that’s it. That’s my pep talk. I offer it to you not to brag about how we live, but to stress that you don’t have to ‘live vicariously’ through others. You can do this, too. You can travel the world in retirement… if you really want to.

The choices are yours.

Thanks for reading, “‘Travel the world in retirement’ pep talk.”

This is an updated version from 2023 was originally posted on July 26, 2017.

🙂

More inspiration!

- What is cost to travel 1 year in Asia post-Covid

- What we spent in four years of world travel

- Lunch with international celebrities! The Kaderlis!

- Budget breakdown: What it cost to live 1 month in Montenegro

- Living expenses: What it cost to live 1 month in Lisbon, Portugal

- The real cost to retire to Chiang Mai, Thailand