-Could we access our money?

-Would ATMs work? Money transfer services?

-What about credit cards?

-Are our future PAID accommodation reservations guaranteed?

-Could we end up homeless/camping somewhere?

These are just some of the frightening questions that have come to mind related to our nomadic slow travel lifestyle and the looming U.S. debt ceiling crisis.

Debt ceiling debacle as it relates to budget slow travelers

We’re all generally aware of the U.S. debt ceiling debacle. And many of us have read the various predictions for what might happen if the United States of America were to go into ‘default’ — unable to pay its obligations.

The scenarios are hypothetical at this point – and highly variable depending on the government response. Still, it is undeniable that the overall situation is not good for economic stability and consumer confidence anywhere.

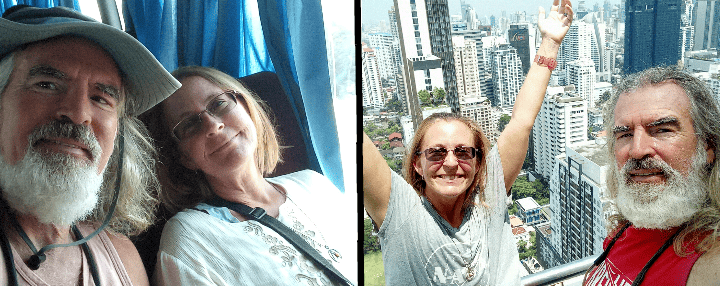

As Americans currently wandering around on the other side of the globe, some different, unique, and potentially catastrophic consequences have become a concern.

First, let me say clearly, my wife and I DO believe the leaders of our home nation will come to some resolution – as they have always done – to avoid a default. Sadly, our guess is they will again prolong the status quo, kick the can down the road, and create some temporary solution that buys X number of months before the same problems confront us again.

But we sure hope that they do at least that. ‘Cause while the fallout of default would affect everyone, there are some added vulnerabilities to people like us who are traveling, visiting, living overseas as this unfolds.

Debt ceiling debacle might leave slow travelers in a lurch

What follows are a few of the uncertainties of particular concern as we will be ‘on the move’ in June and July – when the consequences of a U.S. debt default would ripple around the world.

What would we do for money?

If the value of the U.S. dollar drops precipitously – as has been widely predicted – our money would be worth far less in India, the United Arab Emirates, and the Eastern Balkan countries of Europe where we have confirmed (paid) airline flights and living accommodations in the coming months. But that fact is manageable.

Access to funds

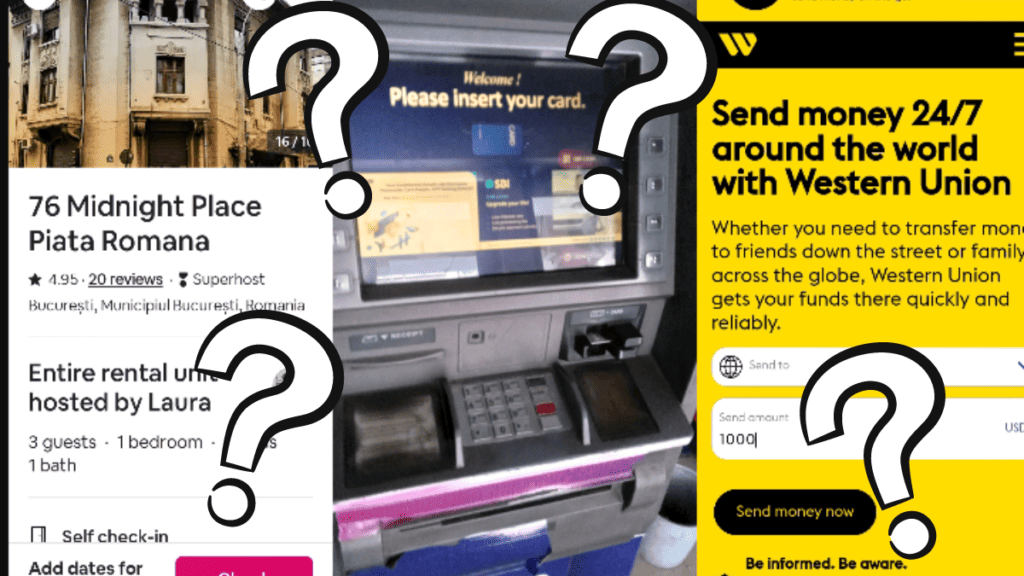

What is completely out of our control is our access to funds to begin with. It’s conceivable that due to wild currency fluctuations, overseas banks might pause consumer banking based on U.S. dollars. Would our ATM cards – which we use for our survival – continue to work smoothly in machines in foreign countries? Obviously, there is a ‘conversion’ involved every time we make an ATM withdrawal. Who could blame any entity involved for ‘pausing’ U.S. dollar conversions during unprecedented turmoil in financial markets. Heck, it’s possible local economies could themselves be so shaken that tending ATM machines becomes the very last concern.

Similarly – credit cards. We have U.S. based Visa and Mastercard which always provide us some backup financial confidence. Would overseas merchants and institutions accept them during a currency upheaval? Even now – in normal times – sometimes basic credit card transactions are denied for no understandable reason. God knows what would happen during a worldwide currency reevaluation.

A little bit of cash

The good news; we do have some cash. At present we carry about $750 as a precaution. We don’t really like to be holding it – or advertising it – but it is true. It’s SOMETHING in case of emergency. But if the dollar would plunge in value, suddenly our $750 could be worth much less. And would we be able to exchange it anywhere? Same issue as above: foreign institutions might pause or decline any dealings in U.S. dollars. But if we’ve just arrived at an airport/border, we need local money. NOW!

Potentially big Airbnb problem

Next: our residential rental accommodations. Recently, I’ve booked month-long stays in both Romania and Bulgaria covering mid-July through mid-September. Those reservations were made – and are already paid for – using the Airbnb platform. Sounds pretty safe. Except right now AirBnb is holding our funds (not the rental hosts). Airbnb simply acts as a middleman – an escrow agent – who releases the funds to the rental host 24 hours AFTER WE CHECK IN.

That means that while I’m thrilled to have booked two fantastic deals for stays in the Balkans, I’ve paid Airbnb in ‘today’s dollars’. They have my $600 per month for each place. But when it’s time to hand the funds to the landlord this summer, the $600 could potentially be worth 30-40-50 percent less if the value of the dollar has cratered. Then what happens?

No landlord would accept the equivalent of $300 in local currency when they contracted for $600. And I can’t see AirBnb voluntarily donating the difference. Best case, I guess, they would turn to me to ‘make it up’ (pay more) before canceling and leaving us out in the street. Worst case; we have nobody willing to host us. We’d need a tent.

Airbnb’s terms of service

For the record, I spent a couple hours combing through the Airbnb terms of service. Nowhere does it make any mention of severe “currency fluctuation”. Likely because they’ve never had to even consider it. The closest thing in the terms is the “Force Majeure” clause seen below. It states Airbnb won’t be held liable for failure to fulfill obligations resulting from “causes outside the reasonable control of Airbnb”. The terms refer to war, acts of God, pandemics, natural disasters; nowhere does it mention political infighting, government incompetence, or economic suicide.

Of course, Airbnb – a gigantic corporation currently holding, and reaping interest on, $8,000,000,000 (yes, 8 BILLION!) in reservation money like ours – can do whatever they want. They could invoke the Force Mujeure (and eventually refund our depressed payments). The recourse for us; arbitration or small claims court. It is spelled out in the terms of service. We’d be at their mercy.

And even if Airbnb sided with us (the terms do say a guests liability is “extinguished” after payment, as we have done) any host could simply cancel or refuse to give us the keys. What could we possibly do? Another dispute process of arbitration/courts? Useless! We need a bed TONIGHT!

Airbnb plans amid debt ceiling debacle

Even more distressing, we have different confirmed and paid Airbnb reservations during the first three weeks of June for Ras Al-Khaimah, Dubai, and Abu Dhabi in the gulf desert emirates of UAE. Then also some week-long stays in Serbia before the month in Bucharest, Romania. All those are closer to the June 1 ‘deadline’ where financial chaos seems more likely. Moving between different locations while all this potentially unfolds is less than ideal — but we’ve had the plans, tickets, and reservations for many weeks already.

Sometimes a vagabond life ain’t easy 😅

All we can reasonably do is carry-on – with the hope that the leadership of our home country comes up with a fix. Abandoning our plans – and non-refundable outlays – based on a potential crisis doesn’t seem wise. Then what? Honestly, it almost feels like we’re going back in time to the COVID-19 days when were stranded in the Philippines. We’re helpless.

Once again, the world is wobbling and us vagabonds will hang on and see what happens. It’s always better than working… Lolol! And regardless of the political idiots around the world who regularly show callous regard for the welfare of ‘the people’ — should it be necessary, we are confident in the support and care of regular folks like us, be it here in India, the desert gulf, or the mountains, rivers, and seashores of Eastern Europe… even if we end up in a tent.

We live in interesting times. And we we intend to continue to make the best of all of it. Incidentally, anyone with ideas/suggestions for the upcoming uncertain period is welcome to offer input. We are kicking around a few more ideas. But in addition to watching and worrying — we’re listening.

As always, be thankful and generous, happy trails & more beer.

Life is NOW!

Thanks for reading, “Debt ceiling debacle might leave slow travelers in a lurch.”

Other money matters

- How to retire early and travel the world

- What it cost to travel 1 year in Asia post-pandemic

- First 4 steps you can take towards early retirement right now

- Early retirement pep talk

- Do you really need a million dollars to retire early and travel the world?

- Best places to retire in the world on small budgets

- What progressive eyeglasses cost in the Philippines

- How to travel cheap and handle 10 problems

- 3 reasons to rent in retirement and travel the world

- Living in Airbnb in early retirement (updated 2022)

Afraid of health care overseas? Don’t be!

Our special guide on global health care shows you:

- 7 easy steps to find the right doctors and hospitals

- Specific price examples for various medical services

- What to know about medical visas

- And more!

We go without travel health insurance, but many of the principles apply to those with coverage.

I agree with your sentiment that our “leaders” will do what’s necessary to avoid the financial chaos that will ensue if the debt ceiling is not raised. However, it does feel like we are dealing with a completely different animal in the house this time around. So there is some cause for concern. The debt ceiling has never been and should not be used as negotiation tool. Get it done and then debate fiscal policy after. The risk to our country and the world is too great. As you point out, us nomads have a somewhat unique set of circumstances to deal with in a worst case scenario. However, our knowledge and comfort with moving about the world, as well as our ability to pivot and adapt, make us more capable than most to handle whatever comes down the pike. Then again, all of my optimism regarding us more than capable Vagabonds goes to shit of we cease to have access to our money.

“They say that money isn’t everything. But it’s like to see your live without it.” – Silverchair

Carry on. Safe travels.