Last Updated on September 21, 2021 by Ellen

The first month of 2020 is in the books. Wow! That went fast. I guess that means we’ve been enjoying our time retired and traveling in the Philippines. As they say; time flies when you’re having fun.

Of course, as always, we keep track of every penny that we spend on our endless, retired, budget travel journey. And now we’ve compiled and crunched the numbers for January 2020.

We strive to keep our monthly expenses under $2,000. And we’ve been pretty successful in that effort over the past year as we moved around Southeast Asia. (Links to other expense breakdowns are at the bottom of this post.)

But last month, we made some “budget buster” purchases.

Retired and traveling — and busting one month’s budget

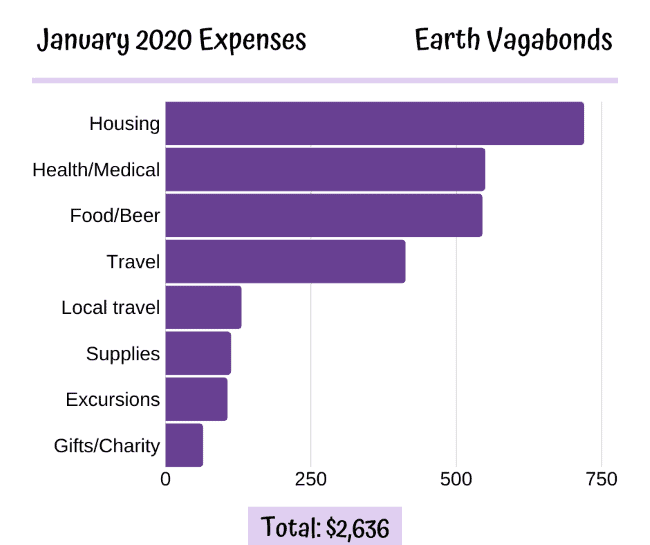

Below is our exact cost breakdown for January. Hopefully, it will help you understand precisely what it can cost to live a comfortable, fun, stress-free life in a beautiful, tropical location — and what kinds of things might bump your budget off balance.

$719 Housing

$549 Health/Medical

$544 Food & Drink

$412 Travel

$130 Local Travel

$112 Supplies

$106 Excursions

$64 Gifts & Charity

_________________________

$2,636 total for 2 people

Budget goal: $2,000

Budget buster: Health/Medical

The biggest budget-buster number on the list above is the $549 that was spent on Health/Medical. In our case, this figure represents Ellen’s bi-annual prescription refills (plus $34 for a separate doctor visit and antibiotics) – so it was not completely unexpected.

But when getting six-month supplies of prescription drugs as we travel around the globe, we never know what the cost will actually be in any given country. The previous purchases of the same prescriptions in other nations have ranged between $350 and $450.

Read How to buy prescription drugs overseas in 5 easy steps.

Of course, hopefully, you won’t have prescriptions to fill if you live overseas. But many people will. And all of us could certainly face unexpected medical bills at any time anywhere.

Budget buster: Visas (in Travel category)

The other big expense which WAS largely unexpected was our Philippine visa renewal fees, which are reflected in the Travel category. (Local travel is taxis, buses, Grab/Uber, etc. Travel is long-haul ticket fares and visas).

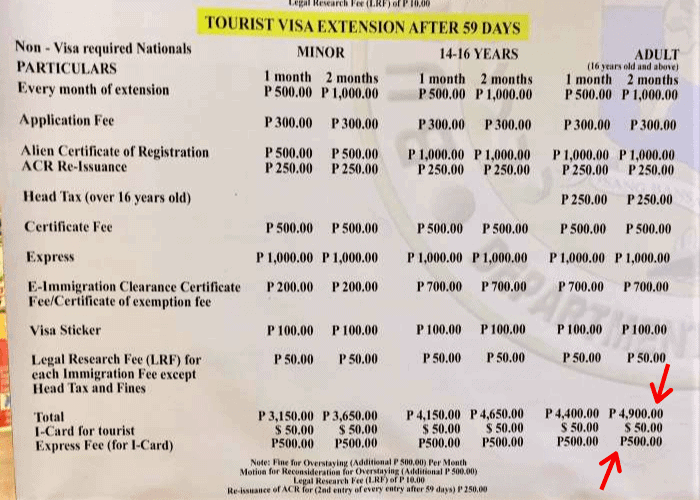

A two-month visa renewal was $155 per person — $310 total! In our experience, visa costs in Southeast Asia average about $1 per day per person. But the Philippines gouges visitors by requiring the purchase of $50 ‘I-Cards’ each year for anyone staying longer than two months.

Even worse, they charged a $10 “express fee” — even though the card takes 60 days to process! Ridiculous! But it’s the cost of legally remaining in the county, so we pay.

Read Visa policies around Southeast Asia for expats.

Here is the official price chart for Philippine visas. Note the bottom right: only the I-Card is priced in U.S. dollars. Click to enlarge.

Budget buster: Housing

Finally, in January we also paid about $120 extra in “double” housing. On three different occasions we decided to take side trips from our home base apartment and pay again for overnight accommodations elsewhere.

Obviously, paying two rents simultaneously is not ideal. But travelers in our situation sometimes choose to explore other places temporarily. We call it a vacation from our permanent vacation.

Retired budget travel rule: Be flexible, have extra funds.

All of this serves to underscore that a budget can rarely be set in stone – especially when traveling long-term. Things happen. Opportunities present themselves. Spending overages occur. Just like at home, travelers need to have some backup or emergency funds for those situations.

It’s tempting to add up the unexpected expenses – in this case, somewhere between $500-$800, depending on what you choose to include – and subtract that amount from the monthly total, and thereby come in ‘on budget’. But those are real expenses that draw down savings or income or reserves so that approach is disingenuous and dangerous.

In all, we recommend a 20 – 25 percent cash cushion — at a minimum — to any travel budget.

And in fact, if you don’t have substantial monetary reserves or continuing income, you are probably not yet prepared for a long-term, retired, budget travel lifestyle. But don’t despair; keep working, saving, planning.

As for us, we are blessed to have saved and invested wisely over 30 years. The experiences in January were priceless. The overspending understandable and necessary.

And in the bigger picture, any single month is just another bar on our long-term spending chart. Next month and beyond, we will effort to be back on budget.

As always, be thankful and generous, happy trails and more beer.

Thanks for reading “Retired and traveling — and over budget.”

You might also like other monthly expense breakdowns:

- What it cost to live in Chiang Mai, Thailand, 1 month

- Expense breakdown for 3 months of travel in Western Europe

- Retire and slow travel in Montenegro: what it cost

- The price tag to live 1 month in Bali

- Kuala Lumpur expense report for 1 month of retired life

We also have yearly totals:

- 2019 expense report for Earth Vagabonds

- 4 years of continuous travel: what it cost to be free

- 2017 expense report for Earth Vagabonds

Is continuous budget world travel right for you?

- How to test if you’d love a full-time travel lifestyle in retirement

- What if every day was a vacation?

- Early retired budget travel pep talk

Visit our boards on Pinterest!