Last Updated on May 28, 2023 by Ellen

Last Updated on May 28, 2023 by Ellen

I’m frequently asked: How can you afford to retire early and slow travel the world? And sometimes people ask: How much money do you have?

The short answers: we saved money, made investments, spent wisely, didn’t have kids, took some risks. And we had enough money to retire early and slow travel the world — on a budget.

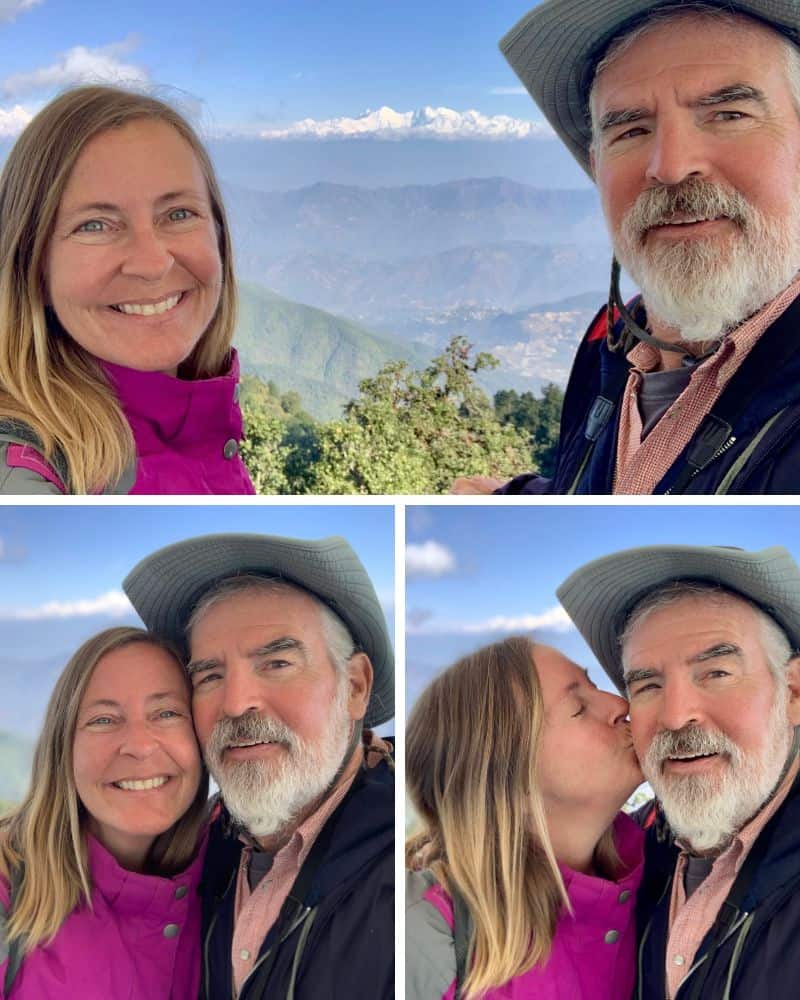

This is a detailed post about exactly how spouse Theo and I accomplished early retirement.

The overview answer is on our About page.

Our budget breakdowns give you examples on our monthly and yearly budgets for slow travel in early retirement.

What follows is part of the story of us – how we did this – how we were able to make our dream come true – to retire early and slow travel the world.

Maybe some of our story will help you.

How to retire early and travel the world

You don’t have to be an accountant, a financial planner, or day-trading wizard to put a plan together – we aren’t those.

You don’t have to make a ton of money – we didn’t.

The secret to this is three key premises to live by, long term:

- Save early and invest consistently

- Don’t have debt

- Live below your means

Yes, it is really that simple.

(Here is the ‘but’ you are expecting–) But: you have to stay committed and follow through, and that’s what makes this so difficult for most people. I know this from personal experience.

The pressure to spend money in our advertising-crazy culture can be extra heavy. It’s all so tempting: a new smartphone upgrade, a new car, a bigger home, new ‘name brand’ shoes, expensive vacations and new clothes to go with it, useless tchotchkes, specialty foods instead of more sensibly priced store brands, and on and on and on down the line. It all adds up.

If you took money spent on the latest and greatest fill-in-the-blank, and invested it instead, you’d be much closer to financial independence.

Our story

When I met Theo (aka Tedly), I was a 29-year-old single woman, drowning in student loan debt and hardly making enough money to pay it down, while also paying rent and other bills, maintaining a used car, feeding myself, and trying to look ‘nice’ for a job in an industry that held physical polish in high esteem – TV ‘news’.

Save for retirement? You’re kidding, right?

Tedly was a guy who lived below his means, yet he also enjoyed life with his own home. He took budget-friendly winter vacations to warm locations, he had hobbies like ice hockey and motorcycles, along with many other nice extras. He also worked in TV ‘news’ as a photographer.

We worked in the same industry – in the same TV station – so I knew he wasn’t making a huge salary. So how the heck did he manage to save so much?

The answer: he had a handle on his spending.

On my 30th birthday in 2001, Tedly surprised me with many gifts: a leather purse, a jacket, trendy earrings and necklaces, Starbucks coffee, and other goodies. All name brand. (Tedly being Tedly, he also stuck a package of Depends into the giant gift bag, with a note that said it’s all downhill from age 30.)

I thought: what a good guy, to gift me all of this stuff – how sweet is that?

What I found out later was that he had a ‘gift closet’.

He went to super sales where he found goods for up to 80 or 90 percent off. He stocked up on goods for later disbursement.

I had known people throughout life who had done that, but I had never paused to evaluate the reason and appreciate the effort in the name of saving money by being a smart consumer. Tedly gave me that pause.

Maybe, just maybe, it would be possible to retire early and slow travel around Earth.

Simple strategy to retire early

Tedly used other methods to save money – and you might do some of these already.

But ask yourself: Are you religious about it?

Tedly bought groceries from a discount chain.

Same damn items – but at a fraction of the cost from a regular supermarket – the type where I normally shopped.

He didn’t buy or lease new cars all the time.

When I met him, Tedly drove a pickup truck that was falling apart. He bought a new car only after amassing discount points on a credit card and when automakers had a fire sale after September 11, 2001.

His housing costs were low.

Tedly paid a mortgage on a modest home in a somewhat seedy part of town. He paid it off some years after I met him, and the investment really paid off. It is a great house in an area that has since gentrified and it’s real estate in high demand.

His simple strategy: pay bills and small debts, spend wisely, save a lot of your money, and invest it.

And then: be religious about it.

I was so curious — here was this sweet, goofy guy who made jokes and had fun with everything he did, and yet when it came to money – he was dead serious.

Start saving as early as you can

When I think back about how I treated money before I reached 30 years old, I cringe. The younger I was, the more foolish I was. Even after 30 years old, I still spent more money than I should have.

Here is a big example: I bought a new 2002 Jeep, and spent years paying that off. I could’ve gone with something cheaper – such as a used Wrangler, which would have satisfied my dream of having a fun four-wheel drive. After all, I had bought used motorcycles and had a blast on them.

In addition to the payments, the Jeep was a gas guzzler, so that only added to its total cost.

In the plus column, it was the only new car I ever bought, and I drove her til she died.

As the daughter of former business owners, you’d think I would have been better at managing my spending before I met Tedly. I guess it takes what it takes, and the universe unfolds as it should. I didn’t earnestly try to learn about money and spending until Tedly showed me how to be smart about money – and saving and investing.

What was he saving all that money for? Exactly this: retire early and travel the world.

We got a taste of what that lifestyle might be like back in 2002 when we began to travel together on work vacations. During these weeks, we realized how little money we really needed to live a great life — outside the U.S.

Slow travel “trial runs”

We went to many places on vacation each year during our working lives until we retired: Mexico, Panama, Costa Rica, Nicaragua, road trips around the U.S., Vegas, etc.

Tedly’s dream was to travel nonstop before he was 65 or 70 years old. I loved that idea. It also became my dream.

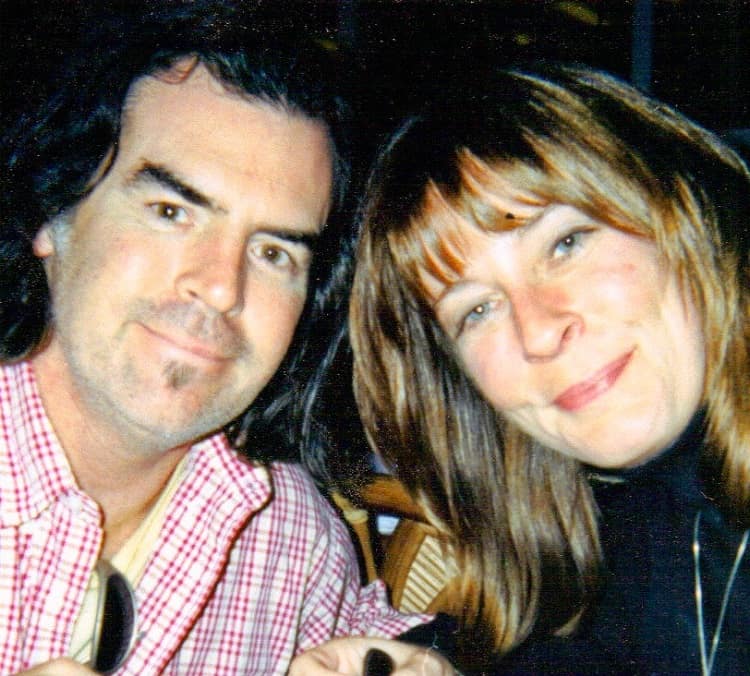

Below is a picture of us back in 2007, on one of our many week-long vacations to Tulum. We would dream of never going back and wish we could retire early and slow travel – full time.

I didn’t want to wait — I was impatient.

Why couldn’t we drop out and travel right now? I often questioned Tedly in our working/travel/dating days.

We could simply get jobs as we needed them, I reasoned, and that would add to the savings we already had. But Tedly wanted sure footing, and he didn’t want to work again once he stopped.

So I paid attention. I cut my spending, paid off that student loan, made a serious effort to save. He taught me a little about investing.

By the time 2007 came, I had stocks that were doing well. When some of those companies took big hits in 2008, I panicked and sold some of them. That taught me about capital gains and losses.

It also taught me that downturns are the absolute best time to buy, not sell.

That first lived-through recession won’t be my last, and I know I have a lot more yet to learn.

Tedly’s money maturity taught me a great deal. Even though I am not as good at investing and managing my money as he is, over the years I still accumulated a decent sum in retirement, stocks, and savings accounts.

The magic of compounding

Remember when I said to start as early as you can? This is why.

Tedly’s accounts will always be larger than mine – he is eight years older than me, and he started saving at an earlier age — 21 to my 31 years.

However, my smaller sums have grown a lot since I started. So it wasn’t “too late.” In fact, it’s never too late to save for the unexpected.

Despite my growth, it is Tedly’s long-term, consistent strategy launched early in his career that made a huge difference. For more than 25 years, Tedly saved at least 20 percent of his income and he continuously invested that money.

How much money do we have?

We don’t feel comfortable sharing the specifics of our personal financial information. We do share many budget breakdowns by year and by month on this website. (And I’ll touch on those a little further down.)

So let’s just say we had enough to retire early and slow travel the world — on a budget. Budgets are relative, but we started our dream life with a $2,000 per month budget in late 2015. (Update in April 2023: likely to increase our budget as we leave Asia.)

There are plenty of other early retirement bloggers and authors who are happy to share their financial details, including net worth, if you feel you need a specific yardstick with which to measure your own progress.

While some people share exact details, others remain anonymous.

Related: Do you really need a million dollars to retire early and travel the world?

We also don’t make specific investment suggestions because everyone is in a different circumstance with different goals — we are not certified financial planners.

Everyone has a unique situation.

Children & property

I mentioned we did not want children, and that undoubtedly added to our financial growth faster than if we had wanted to raise a family. But we certainly know plenty of people who did raise kids, and they are now retired and enjoying a travel lifestyle.

In our case, Tedly’s former home is a now a rental property that helps us pay for places we rent around the world. That home is a modest property in a ‘cheap’ city. He took a risk in a mixed neighborhood decades ago – and it paid off. Today that house is in a sought-after neighborhood.

How will you write your story?

There isn’t a one-plan-fits-all approach to this beyond the key basics we’ve already covered.

Don’t have debt. Live below your means. Save and invest early and consistently.

And then, stick to those key basics.

Anyone can adopt this as a base plan, and tailor it to your specific needs, risk levels and investment preferences.

Find a certified financial planner

Countless personal finance sites, blogs, and books detail how you can realistically retire early. But any plan of action you put together should be vetted by a certified financial planner.

Ask around from people you trust for recommendations.

If no one you know can make such a recommendation, find planner who has a lot of reviews over a period of time.

In our case, Tedly paid a financial planner a one-time fee to review the plan and asked, What am I missing? before we were married and we sailed off into the sunset.

The planner didn’t find any holes in our plan but he did make suggestions that made sense.

The secrets to retire early and slow travel the world

If those key basics are the ‘secrets’ on how we got here, it’s time to share the secret on how we stay here: by sticking to a budget.

That’s why we are *budget* slow travelers in early retirement.

Our budget in Mexico and Central America was around $2,000 a month. Our budget in Europe was higher – about $2,400 a month. In Southeast Asia, we spent less than $2,000 a month.

We were comfortable on these budgets! We got to do amazing things, like Sahara Desert trips, hikes up volcanoes, swims with whale sharks, trips to protected ocean reserves, jungle treks to Mayan ruins, living on a floating house, walking and bathing elephants — just to name a few of the more active adventures we’ve enjoyed.

Did you know Earth Vagabonds spent 2+ pandemic years in the Philippines?

Earth Vagabonds ‘got stuck’ in a rural area of the Philippines when the pandemic began in March 2020. Ellen, Theo, and his mom Diane (who was traveling with Earth Vagabonds at that time) decided to help the indigenous Ati tribe while there.

See our special page about that experience.

Aside from those unique adventures, we also get to ride around on buses in exotic places and check out a new culture. We can also be lazy at “home” and read, or take leisurely trips neighborhood beaches, or go to concerts and museums.

We spend our time how we want to spend our time. Because Life is Short. And: Life is Now.

Living the Dream

Tedly was 52 and I was almost 44 when we decided to retire early and travel the world. We almost didn’t stop working that early. In fact, one plan we kicked around after I moved to San Diego from Cleveland (we weren’t married yet) was that Tedly could retire first and join me in California as my house wife (my job was kind of demanding) while I kept working a few more years.

Honestly, all of our ‘plans’ felt more like just talk to me. It was difficult for me to really envision a life of travel in early retirement. Remember I shared how I can be impatient?

Well, the universe flowed in a way to help me along and realize the dream. I was laid off. I decided to back out of the rat race with a severance offer added to my coffer.

The universe gave me a final shove in the message from a woman dying of cancer. She reminded me of the most important thing: you only live once.

Why did we want to retire early and travel the world?

My answer: I want to see the world! I love being on my own schedule at my own pace as I explore new places and cultures. Life feels like a permanent vacation.

Tedly’s answer: What else is there to do? And also: Because I’m from Cleveland and it’s the ABCs – Anywhere But Cleveland. (He’s joking. Kinda.)

There were obstacles outside of finances that we each overcame before early retirement – this isn’t our entire story, by far. So having the funds to retire early was only part of the challenge to get here. Another big hurdle was finding courage to take the risk and actually do it.

We haven’t looked back. It’s clear to us how fortunate we are — to unwrap and experience this gift of retired budget travel. We both are immensely grateful.

This page was updated May 18, 2022 to include information about Earth Vagabonds leaving the Philippines after more than two years. It was updated again in October 2022 after more post-pandemic traveling, and again in April 2023 after yet more traveling in the ‘new normal’.

Thanks for reading, “Retire early and slow travel the world: Our story.”

See where Earth Vagabonds have been, and where they are right now.

Earth Vagabonds Newsletter

Do you want to retire early and slow travel the world? Get free tips each month from our newsletter!

🙂

Budget slow travelers in early retirement

I read your blog post twice, I loved it so much. It absolutely resonated with my thinking, every word of it. There are significant differences between our stories, for example I had a high paying job that made it easier to retire, but the core is the same: Live below your means to afford retiring early, because we realised we only live only once when our respective friends battled deadly cancer. I also agree that 2400 USD gives you an amazing travel life in Europe even even better in Asia or South America. Before taking a break from the rat race I couldn’t imagine living on such a Budget but it is totally doable when u make smart choices. Cudos to you two. Very impressed with your story. Looking forward to more.

Wow! Thanks for sharing your story – very inspiring. My hubby and I are budget travelers too who wants to retire and travel more someday?

???